Buying a house ranks high among the top lifetime decisions; along with choice of a careers, college, spouses and towns to live in. Like some of the other big life decisions, buying a house is more emotional than purely rational. People generally don’t choose a house, they fall in love with it! The sense you get within 10 seconds of walking into a place that it is just right. For many people, the whole experience is difficult emotionally and economically. I am of no help on the emotional part of the decision! Instead, I try to expand on the economic part.

Living in the Austin area, one can not escape constant reminders about the increasing housing prices. Perceived high down payment is enough to scare most people away from even thinking about it. Affordability is a concern, and sometimes it seems buying a house is totally out of your reach. In my previous posts, I have written about ways to secure the down payment using one of available programs, how to deal with other obstacles, by improving your financial health , and always be on the lookout for plans and programs for a more affordable housing.

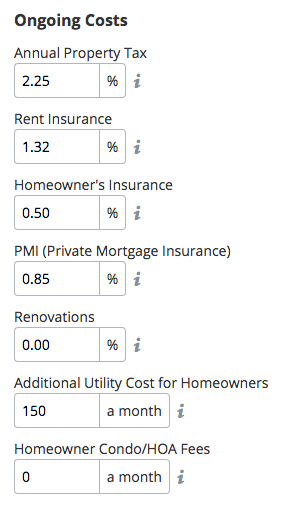

In addition to the down payment, cost of home ownership is an important factor in making an economic decision about buying. To make rent vs. buy decision realistic, all expenses and individual situation has to be considered. A realistic comparison should make it easier to make that economic decision easier.

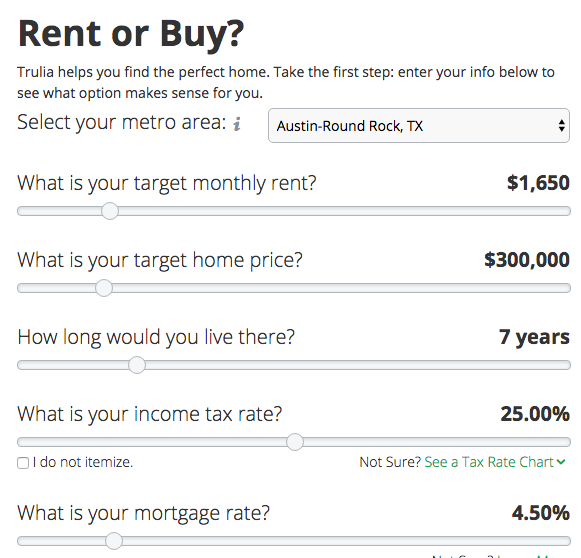

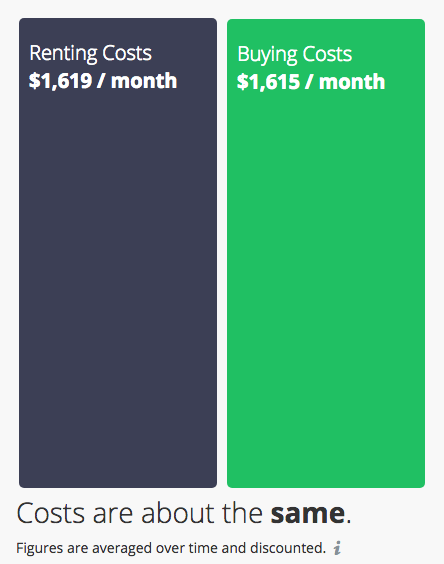

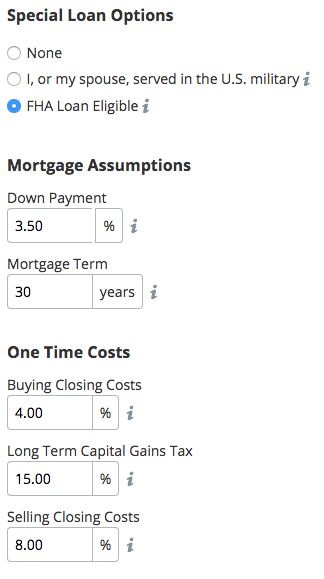

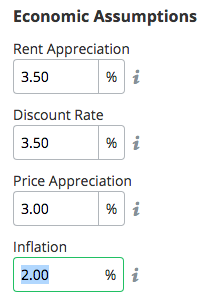

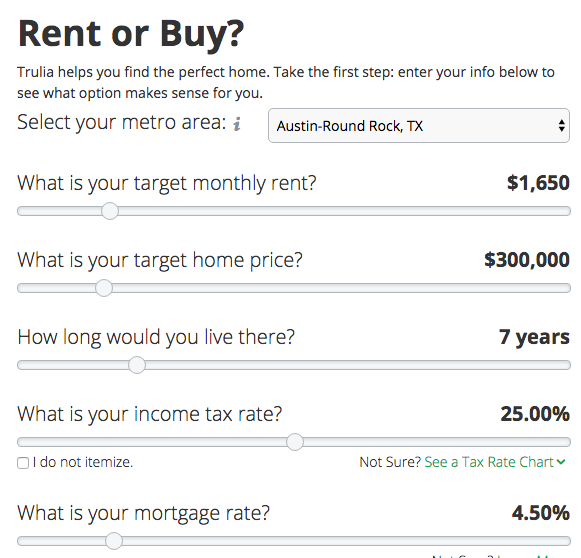

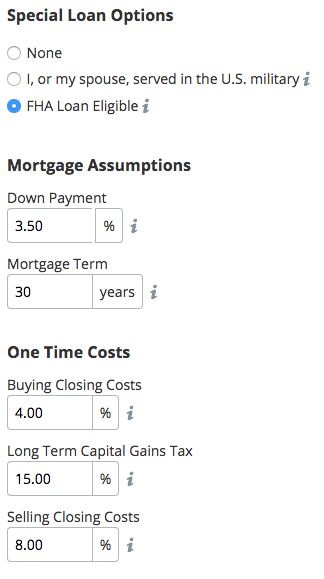

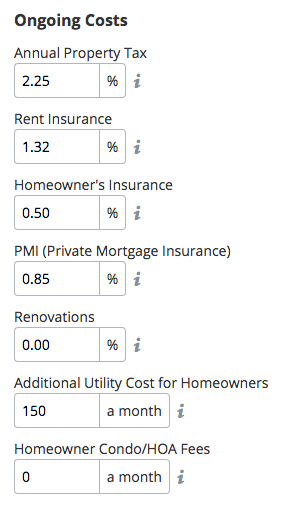

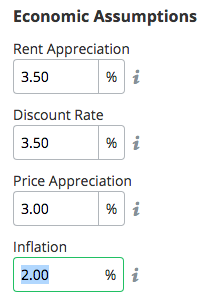

There is an on-line tool that takes most of these variables into account. Let’s assume you pay around $1650 monthly rent for a 2 or 3 bedroom apartment. Now if you buy a house priced around $300,000 (which is close to the median price of the house in Austin)) and assuming you get an 30 year FHA loan with a 3.5% down, taking into account your expected annual property tax of roughly $6600 and $1600 of home owners insurance. Taking these into consideration and allowing some extra utilities cost that you may have to pay if you own your house, the ‘ownership’ cost of a is around the rent payment of $1650.

Now, if you can pay extra for down (10% instead if 3.5%) and now you can afford a larger house (around $340,000) or lower your monthly payment by $200; making owning a house to be even cheaper than renting.

|

|

|

To better fit your individual

situation, expand parameters

under Advanced Settings. |

When considering owing a house, be mindful of other payment obligation. In general the 1/3 rule applies; meaning the debt payments, including your mortgage loan payments, should not exceed one-third of the net income. Although the bank may lend you more money, this 1/3 rules puts you in the safe zone ensuring that you are well within your means. Working out the affordability in this way would ensure that repayment of debt is never a burden on the individual.

If you have more question on this or other aspect of home ownership, please contact me.

Best wishes,

|

| 11507 Hare Trail | Austin, Texas 78726

c: (512)740-6945

w: www.moeproperty.com

e: [email protected] |

|

|

|