November 2016 Market Summary Report for Central Texas; including Austin area, Travis, Williamson, and Hays Counties.

![]()

![]()

![]()

![]()

![]()

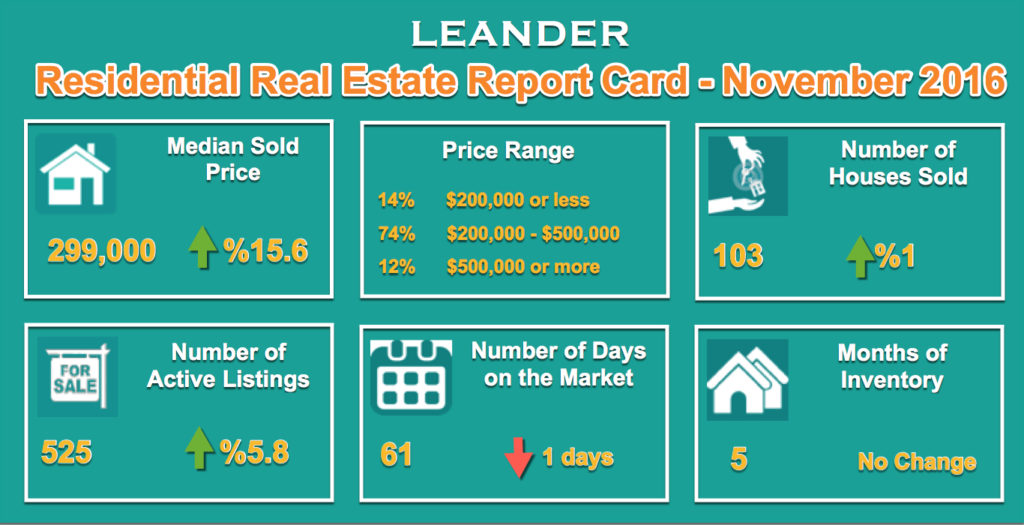

Leander Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Leander housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to very good level of demand for the houses in Leander as compared to 2015. The number of days in market is at a healthy level roughly two months. If a house is priced correctly, it will sell at a reasonable time. The median price of the Leander homes sold is still climbing, and inventory of the houses for sale is at the same level as last year at the same time. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

The Leander single-family home sales during November 2016 is summarized below. All comparisons are relative to September 2015.

You can explore details of all the Leander home sales in November below.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

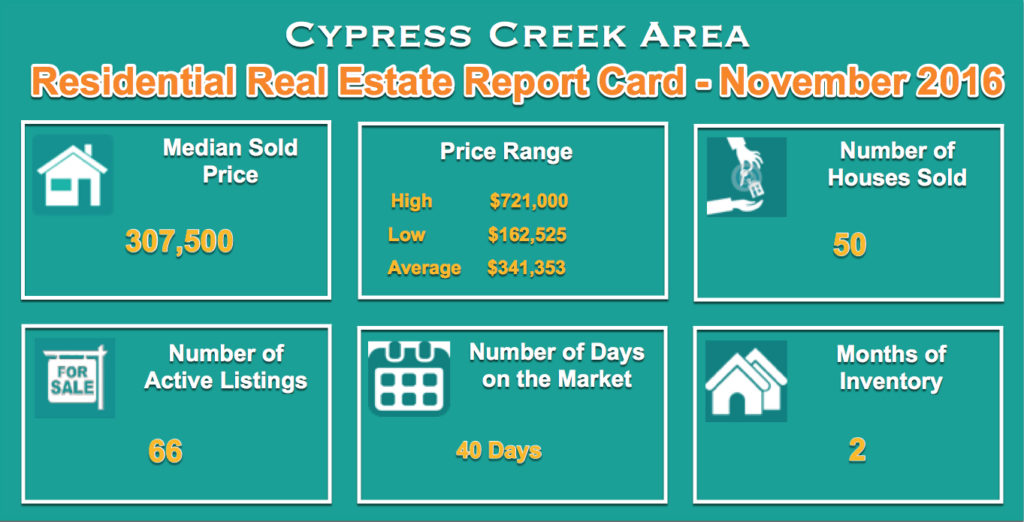

Cypress Creek & Neighboring Communities Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Cedar Park housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to solid demand for the houses in Cedar Park as compared to 2015. A look at the number of days in market shows the level of demand and how quickly one expect to sell a house (average 37 days). If the house is priced correctly, it will sell fast! The median price of the Cedar Park homes sold is still climbing, and inventory of the houses for sale is at the same level as last year. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

More specific to the Cypress Creek and neighboring communities, single-family home sales activities can be summarized as:

You can explore details of all the 50 Cypress Creek are home sales in September below.

The Cedar Park single-family home sales during November 2016 is summarized below. All comparisons are relative to November 2015.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

![]()

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

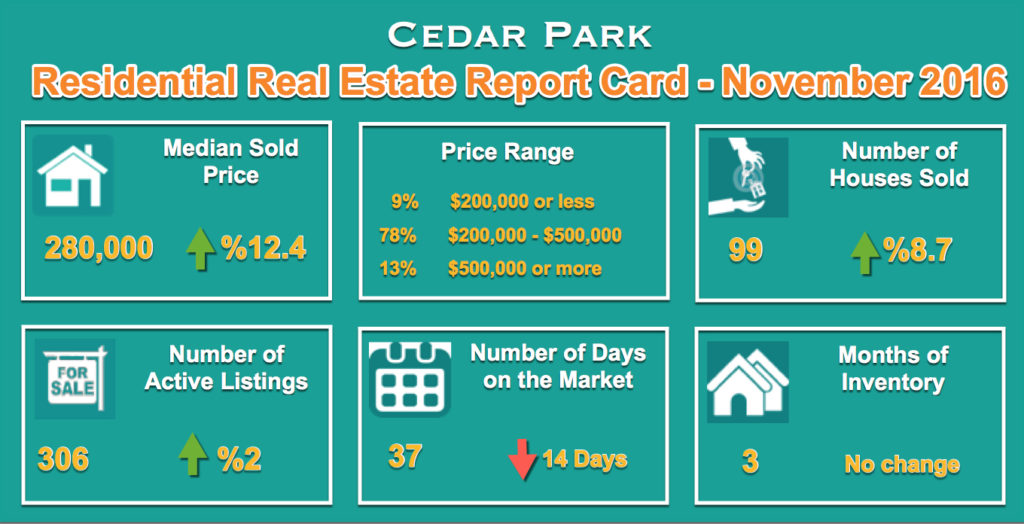

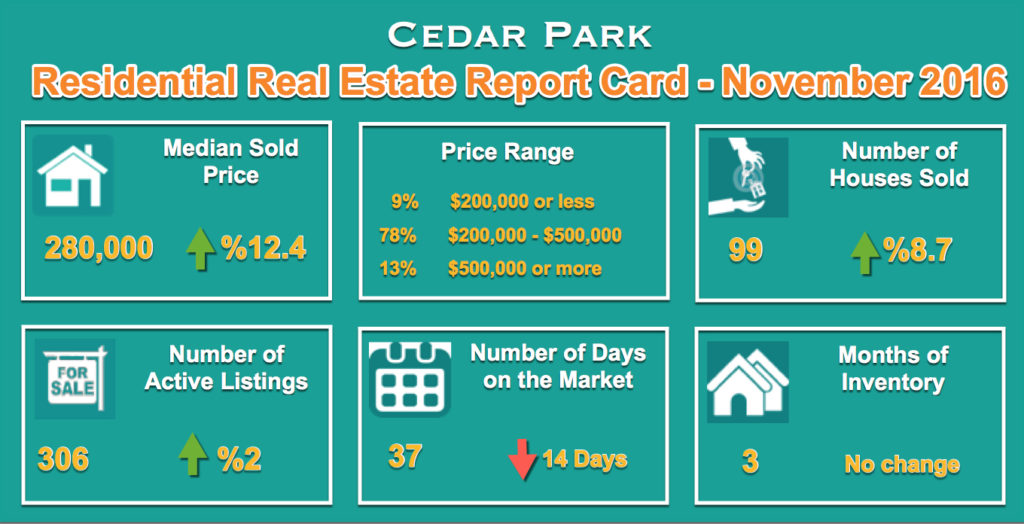

Cedar Park Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Cedar Park housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to solid demand for the houses in Cedar Park as compared to 2015. A look at the number of days in market shows the level of demand and how quickly one expect to sell a house (average 37 days). If the house is priced correctly, it will sell fast! The median price of the Cedar Park homes sold is still climbing, and inventory of the houses for sale is at the same level as last year. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

Here is a report card for single-family home sales in Cedar Park area in November 2016. All comparisons are relative to November 2015.

You can explore details of all the 112 Cedar Park home sales in November below.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

![]()

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

Buying a house is a personal decision that follows a period deliberation and planning. Many factors goes into the timing of a purchase; mortgage interest rate is an important factor in accelerating or postponing the decision to buy. If you have decided to buy a house in the coming year, or still on the fence about the timing, knowing which way the interest rates are headed is an important factor in your decision making.

Some historical perspective could be helpful in understanding which direction the interest rate may move. We’ve had close to a decade of historically low interest rates especially after the financial collapse of the 2008-2009. Financial experts all agree that the main reason for the collapse was mortgage loans that were issued to financially unqualified or borderline qualified borrowers.

After the economic collapse, to get the economy moving again, among other measures the Federal Reserve Bank cut interest rates on several occasions and kept it low for the past 7 or 8 years. In essence both the low interest rates and current higher standards for borrower qualifications are tied to that financial calamity.

No one is certain but some of the factors could influence direction of the interest rates in the coming years.

These trends lead the housing industry experts to anticipate that the rates could rise to 4.75 in the next year or so, up from the low 3.5 earlier this year. Possibility of continued interest rate increases, and a better job market, could get many would-be buyers off the fence and into homeownership.

Higher mortgage rates may discourage existing home owners from selling and moving up, but won’t have much impact on the new homes being built. There will be some effect on refinancing, as less people are going to refinance or move to higher priced houses.

Supply of existing houses is low and higher interest rates could reduce it further.

As more and more Millennial make a decision to buy new homes, due to sufficient supply of the starter homes, a good portion of them are thinking the mid-sized houses. Home Builders report a trend to leapfrog the entry-level home in favor of the mid-sized or first move-up house.

If you are thinking about buying a house for the first time, or as a move up decision, you should not be discouraged or concentrate on a single factor such as price, mortgage rate, etc. There are always trade-offs in any decision you make. There is underlying reasons for higher home prices, as there is for higher/lower interest rates. They follow market forces that are beyond anyone one person’s control. Be informed and educate yourself on financial trade-offs and make the decision that fits your situation.

I will be glad to help analyze these trade offs, or other aspect of your home buying decision, please to contact me.

Have a wonderful Christmas and a prosperous new year!