November 2016 Market Summary Report for Central Texas; including Austin area, Travis, Williamson, and Hays Counties.

![]()

![]()

![]()

![]()

![]()

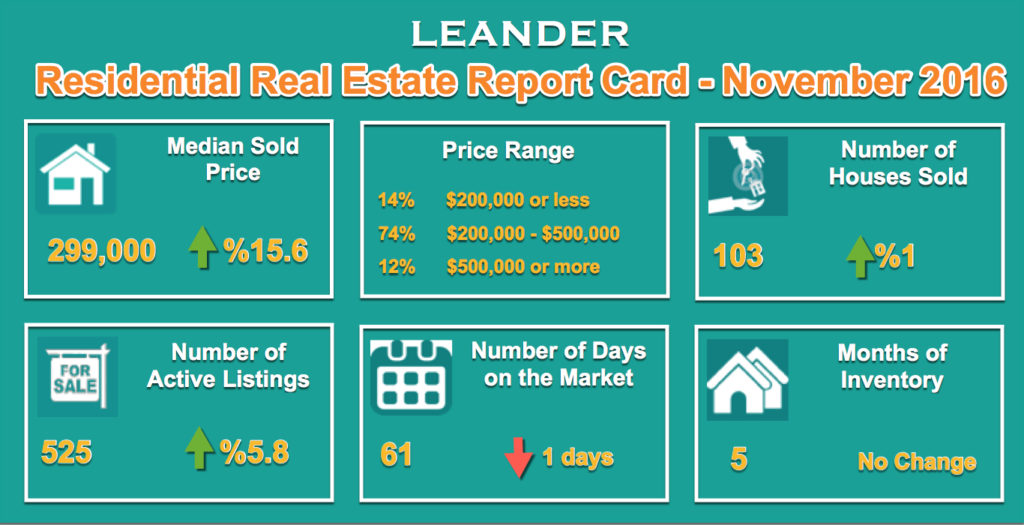

Leander Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Leander housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to very good level of demand for the houses in Leander as compared to 2015. The number of days in market is at a healthy level roughly two months. If a house is priced correctly, it will sell at a reasonable time. The median price of the Leander homes sold is still climbing, and inventory of the houses for sale is at the same level as last year at the same time. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

The Leander single-family home sales during November 2016 is summarized below. All comparisons are relative to September 2015.

You can explore details of all the Leander home sales in November below.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

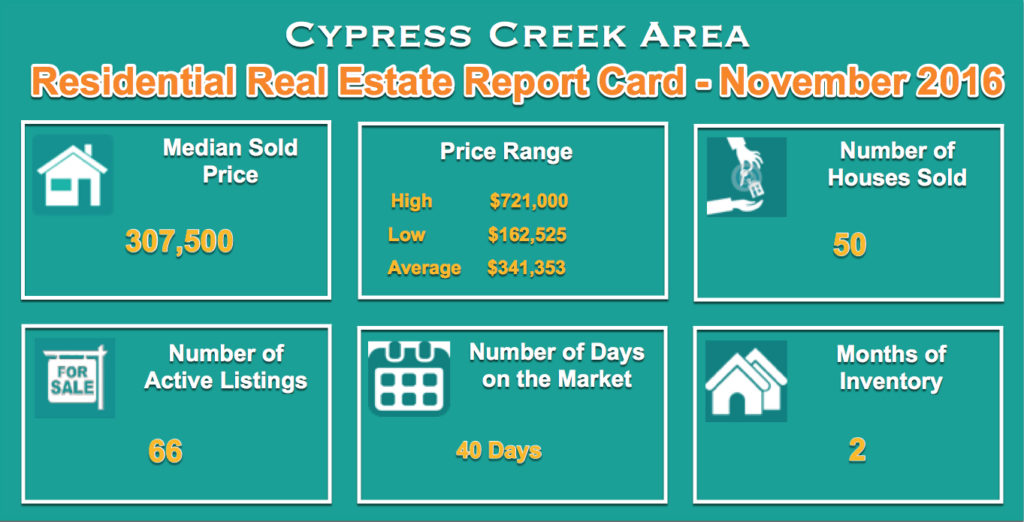

Cypress Creek & Neighboring Communities Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Cedar Park housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to solid demand for the houses in Cedar Park as compared to 2015. A look at the number of days in market shows the level of demand and how quickly one expect to sell a house (average 37 days). If the house is priced correctly, it will sell fast! The median price of the Cedar Park homes sold is still climbing, and inventory of the houses for sale is at the same level as last year. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

More specific to the Cypress Creek and neighboring communities, single-family home sales activities can be summarized as:

You can explore details of all the 50 Cypress Creek are home sales in September below.

The Cedar Park single-family home sales during November 2016 is summarized below. All comparisons are relative to November 2015.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

![]()

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

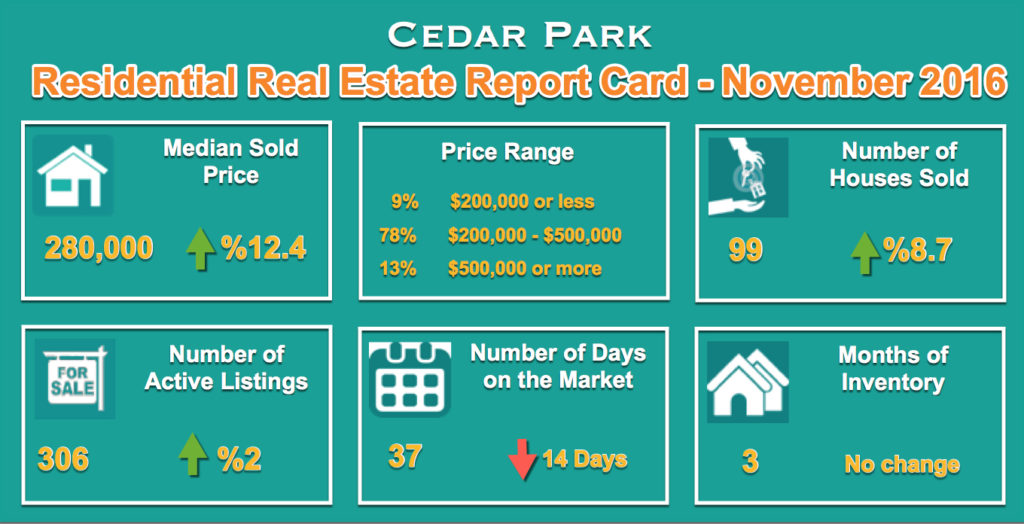

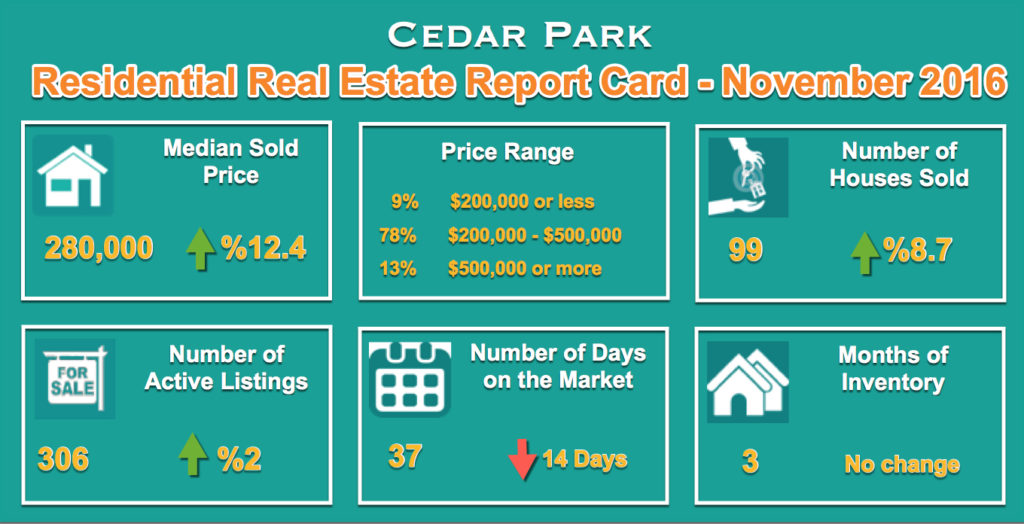

Cedar Park Homes for Sale & Sold Report – November 2016

My next report card will reach you in 2017, so let me start by wishing you a Merry Christmas and a happy and prosperous 2017!

If a move is part of your plan in 2017, this may be the best time to get the house prepared as you prepare for Christmas, There are signs of increasing interest rates in the next year which could impact sectors of the housing market, including the mid-sized or ‘move-up’ houses; houses other than starter homes for first-time home buyers.

During November the Cedar Park housing market marched along increasing appreciations path as evidenced by the following report card. All indicators point to solid demand for the houses in Cedar Park as compared to 2015. A look at the number of days in market shows the level of demand and how quickly one expect to sell a house (average 37 days). If the house is priced correctly, it will sell fast! The median price of the Cedar Park homes sold is still climbing, and inventory of the houses for sale is at the same level as last year. All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

Here is a report card for single-family home sales in Cedar Park area in November 2016. All comparisons are relative to November 2015.

You can explore details of all the 112 Cedar Park home sales in November below.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

![]()

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Wishing you a Merry Christmas and a happy and prosperous 2017! Cheers!

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||

Buying a house is a personal decision that follows a period deliberation and planning. Many factors goes into the timing of a purchase; mortgage interest rate is an important factor in accelerating or postponing the decision to buy. If you have decided to buy a house in the coming year, or still on the fence about the timing, knowing which way the interest rates are headed is an important factor in your decision making.

Some historical perspective could be helpful in understanding which direction the interest rate may move. We’ve had close to a decade of historically low interest rates especially after the financial collapse of the 2008-2009. Financial experts all agree that the main reason for the collapse was mortgage loans that were issued to financially unqualified or borderline qualified borrowers.

After the economic collapse, to get the economy moving again, among other measures the Federal Reserve Bank cut interest rates on several occasions and kept it low for the past 7 or 8 years. In essence both the low interest rates and current higher standards for borrower qualifications are tied to that financial calamity.

No one is certain but some of the factors could influence direction of the interest rates in the coming years.

These trends lead the housing industry experts to anticipate that the rates could rise to 4.75 in the next year or so, up from the low 3.5 earlier this year. Possibility of continued interest rate increases, and a better job market, could get many would-be buyers off the fence and into homeownership.

Higher mortgage rates may discourage existing home owners from selling and moving up, but won’t have much impact on the new homes being built. There will be some effect on refinancing, as less people are going to refinance or move to higher priced houses.

Supply of existing houses is low and higher interest rates could reduce it further.

As more and more Millennial make a decision to buy new homes, due to sufficient supply of the starter homes, a good portion of them are thinking the mid-sized houses. Home Builders report a trend to leapfrog the entry-level home in favor of the mid-sized or first move-up house.

If you are thinking about buying a house for the first time, or as a move up decision, you should not be discouraged or concentrate on a single factor such as price, mortgage rate, etc. There are always trade-offs in any decision you make. There is underlying reasons for higher home prices, as there is for higher/lower interest rates. They follow market forces that are beyond anyone one person’s control. Be informed and educate yourself on financial trade-offs and make the decision that fits your situation.

I will be glad to help analyze these trade offs, or other aspect of your home buying decision, please to contact me.

Have a wonderful Christmas and a prosperous new year!

Beautiful and well-maintained house in the quiet Spicewood at Balcones neighborhood. Just minutes from shopping areas, restaurants and major employers such as Apple and Oracle. Only a block away from Northwest Balcones neighborhood park and blocks away from Balcones Country Club golf course. Acclaimed Round Rock School district with Spicewood Elementary, Canyon Vista Middle School and Westwood High School. Two living areas, wood floor and tile throughout. Remodeled kitchen with updated cabinets and appliances. Large deck for parties and summer BBQ. Well kept front and backyard. Huge backyard with mature trees making it a private sanctuary.

As the single largest purchase of the lifetime for most people, buying a house requires careful preparation and planning. It taps into your financial resources and requires sticking to a timetable for the transaction. The home buying process, from the beginning to the end, could be distilled into the following Home Buying Checklist. Knowledge of the process and advance planning makes the whole process fun, specially if you are a first time buyer!

1 – Beyond the mechanics of contract offers and negotiation , you need someone on your team to guide you and look after your interest during the home buying process. Someone who looks beyond the current transaction for a long term relationship that may expand in the years to come. The truth is that, on the average, people change their residence every 7 years or so. This could be due to job change, moving up or a host of other reason. So, before you start your search for a house, find a real estate agent that you trust.

2 – Get pre-approved by a bank, credit union or a similar financial institution. This is an important, but often neglected step, in home buying process. You may ask why do I need approval before I have even started to look for a house. The answer is simply your peace of mind. To get pre-approved, you provide detailed information about your current financial status (income, current loans and other payments, etc.) to the bank. Based on that information, a determination is made about the mortgage amount you qualify. This gives you an idea about the price range for the houses you can ‘afford‘, thus limiting your search to that price range and prevent you from wasting time considering houses that are simply beyond beyond your financial reach.

Make sure that you explore all available financing options, including help with down payment. Travis county and the city of Austin have buyer’s help for qualified applicants in the form of 0% loan or outright grants. For more information about help with down payment visit here.

3 – You are now ready to start your search for a house. There are many well known resources for your search such as, Realtor.com, Zillow, Redfin, etc. You can also tap into the database of New Homes being built around Austin. Additionally, your agent can provide you access to the Multiple Listing Service (MLS), a database of available houses for sale in the area. MLS is the gold standard for houses on the market and it provide the most up-to-date data about the current houses for sale.

4 – When you find the house you like in your price range, it is time to make an offer. But for how much? How much the house is worth? Is the asking price fair, or is it high?

It is often said that the price of a house is not what the owner is asking. It is not what you think it is. It is not what the selling or the buying agent say it is. It is not what the neighbor think it is. In reality the true value of a house is what you or someone else would pay to own it. That price is determined by the market. How do you find what someone pays for the house you are considering to buy? The best way is, to find out how much people have paid for houses ‘similar‘ to the one you are considering.

Your agent can provide you with a Comparative Market Analysts (CMA) to compare recent sales of similar houses around the neighborhood and come up with an estimated value for the house. This should provide you a basis for your offer price and how much you end up paying for the house. This is often lower than the asking price, but on occasion (in a sellers market and a multiple offer situation) could end up being much higher than that asking price

The price is not the only term of an offer. Other condition and terms, and their associated costs, collectively called ‘closing costs‘ are all spelled out in a legally binding contract. Your agent can help you prepare this legal contract and ‘offer‘ it to the seller.

5 – Negotiation – Once your offer is presented, the owner can accept it, reject it , or change and return it back to you as a ‘counter offer‘. This can trigger new rounds of negotiation over the terms of contract and modify it back-and-forth until you and the seller agree to all the terms of the contract.

6 – Once the house is ‘under contact‘ there are certain time sensitive actions that are triggered after the last signature. Option period, inspection, securing financing, etc. are a few of these terms. You need to make sure the house is in good shape with the help of a professional inspector, finalize your financing qualification with your financial institution (the pre-approval saves you headache by speeding up this process and saving you time). Your bank orders appraisal, to make sure the house is worth to secure the loan amount. Details regarding status of the house as it is spelled out in title document is handled by the ‘title’ company.

7 – Closing – All the documents relating to the transaction and purchase of the house are funneled through the title company and the deal is finalized there. A date is set for the ownership transfer and ‘closing‘ of the deal. The final documents are signed, money exchanged, and you get the legal tile and at the shortly after the physical owner ship of the house. Congratulation you are a home owner now!

Each transaction is different and many have special situation to make it different and/or more challenging than others. If you have question about any of these steps please contact me.

Best wishes,

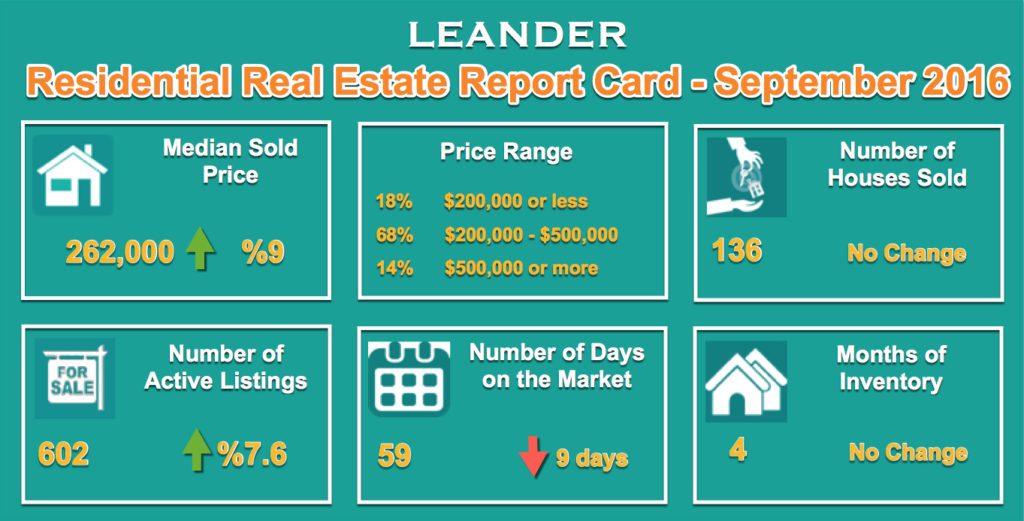

Leander Homes for Sale & Sold Report – Septermber 2016

Greetings! Summer is over and schools have started already. As the holiday season gets closer, some take advantage of cooler fall days and start working on the projects that have been put off until now. If a move is part of your plan in the future, now is the time to spruce up the house and get it prepared.

Fall and winter are slower seasons for selling a house, but as evidenced by the report card below, the Leander housing market has not slowed at all. Although the number of Leander Homes sold in September 2016 doesn’t show any increase relative to last year, the median price of the homes sold in Leander keeps climbing. Inventory of houses for sale shows slight increase relative to last year. The number of ‘days in the market’ is around 8 weeks which is not long at all. Think of it this way, if you are thinking about selling, and put your house on the market today, it should sell before the Christmas! All this indicates that the demand is still strong and available inventory is being absorbed at a quick rate.

The Leander single-family home sales during September 2016 is summarized below. All comparisons are relative to September 2015.

You can explore details of all the Leander home sales in September below.

City of Leander is on a long term growth pattern, the 2015 Leander residential Development Plan has identified 33 different neighborhood development areas, and these plans call for over 14,000 houses to be built or the next few years. The size and location of these areas varies, the largest being Travisso development of over 3400 houses, and the smallest one is a tract of 7 houses in the Parker Tract.

All this activity has affected your home’s value!

If you plan to move, you need to know the value of your home right now. You can find this out in two easy ways:

I hope you find this helpful. Referral is a big part of my business and as always I appreciate your consideration in referring any friends, family, or colleagues my way. Thank you for supporting me and my business endeavors. Please don’t hesitate to ask me questions about real estate, your desired neighborhoods, or your house value!

Best wishes,

|

|||||||||||||

|

|

||||||||||||

|

|||||||||||||