Thinking about buying a house, but afraid you may not be qualify? Whether you are a first-time buyer or moving up, there are a few steps to take and make the buying process enjoyable. Before looking at any houses, or doing any searches on any real estate sites, you need to take the following three steps.

1 – Know your ratios

Whether you are considering the purchase of your first home or trading up to the home of your family dream, there are three crucial numbers you must be familiar with:

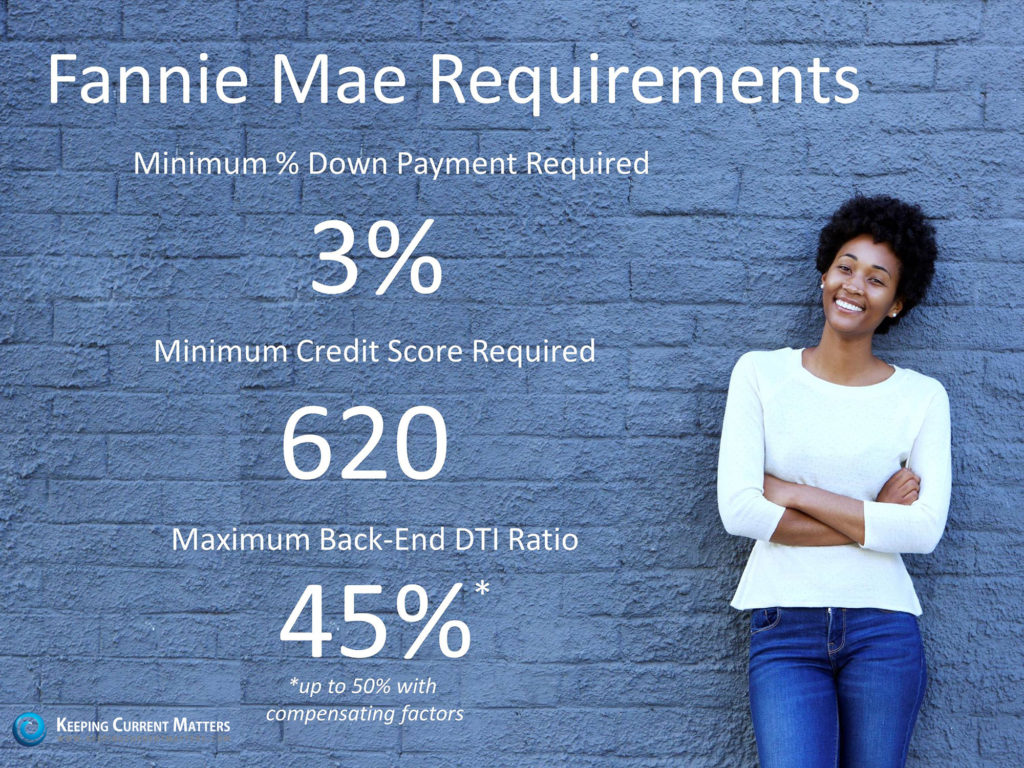

- What is the minimum down payment required to purchase a home?

- What is the minimum credit score (FICO score) required to qualify for a mortgage?

- What is the maximum Debt To Income ratio (DTI ratio) allowed?

To be able to get a loan and be able to afford the monthly mortgage payments, you need to have at least a %3 down payment, a minimum credit score of 620 and debt to income ratio of 45% or better.

I have mentioned some of the down payment assistance programs here. You can download more information about these programs here.

A meeting with a local mortgage lender can walk you through simple process of calculating the of DTI (all your monthly payments divided by your total household income). Any extra monthly payment, such as your car payments, increases this number. The lower the DTI number, the better. Lenders typically do not want it to be higher than 43 percent. However, different lenders have different DTI ratios depending on the type of loan

2 – Look for a local lender

Younger generation, especially the millennial, tend to do most of their shopping, including mortgage rates, online. While it is quite possible to find good rate online, but qualification and application process, including credit issues, better be dealt with locally through your local banks or mortgage brokers.

A local lender can sit down with you face-to-face and talk about the application process, current rates and current programs available for first-time homebuyers.

Most online lenders aren’t necessarily local and may have teaser rates on their websites. There are many down-payment assistance programs that are only available to local buyers, especially first-time buyers.

Regardless of how you finance your home purchase, remember that you can take advantage of the City of Austin and Travis County first time homebuyer programs. Even if you are not a first time homebuyers, or didn’t qualify in the past, it is worth to take a few minutes of your time and check to see how many programs do you qualify.

3 – Get a pre-approval letter

In a competitive market such as Austin, where the number of buyers searching for their dream home outnumbers the number of homes for sale, buyers need to stand out and get noticed. One way to get noticed and have a competitive advantage is to get pre-qualified or, even better pre-approved, for a mortgage before you start your search.

In today’s Austin market, most real estate agents require their buyer clients to have that pre-approval letter in-hand before they take them out looking at houses.

Most real estate professionals have relationships with lenders who will be able to provide you a list of few lenders and help you with the pre-approval process.

Once you have selected a lender, you need to fill out a loan application and provide important information regarding your credit, debt, work history, source of down payment and rental history.

This is what most first-time homebuyers dread and are weary of filling out the application with a lender. They are afraid of the negative credit report and how it may affect buying their dream home. However, even if there are negative points on your credit report, it’s best to find it early in the process with enough time to correct the.

Bottom Line

If you are considering purchasing a home, make sure you are aware of all your options and don’t overestimate the credit and down payment requirements. There are different options and many available programs to help you achieve your dream of owning your home.

Drop me a note here, with your comments or questions.

Here is a graph showing Austin area rent increases in the past few years:

Here is a graph showing Austin area rent increases in the past few years: